Palestinian Captive Market

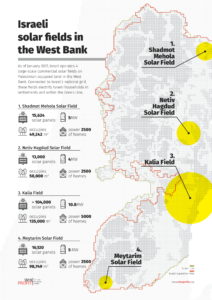

This sub-category refers to Israeli and international companies benefitting from structural advantages in the framework of the Israeli occupation. It includes companies providing services or goods to Palestinians at high cost, exploiting the restrictions on movement imposed on the Palestinians, who cannot purchase these goods and services at a competitive price locally or abroad, and profiting from the active de-development of competitive Palestinian industries.

Isolated from global markets, the Palestinian economy relies heavily on Israeli imports, as the Israeli economy absorbs 93% of Palestinian exports and accounts for 54% of Palestinian imports.

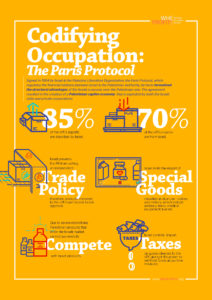

Companies also profit from Israeli control over Palestinian fiscal revenue. Under the Paris Protocol, Israel collects customs duties on imports destined for the Palestinian market, which are required to go through Israel, as well as indirect taxes on Israeli products sold to the Palestinian market, income taxes, and social transfers from Palestinians employed in Israel or the settlements. Not only has Israel weaponized Palestinian fiscal revenues, withholding this as a punitive measure, but it has also illegally retained and used Palestinian import and sales tax money to pay various debts to Israeli companies, such as the Israel Electric Corporation (IEC).